For five thousand years, gold has preserved its status of imperishable, supreme value. Today’s investors are trying to buy precious metals in markets with minimal risk. Over the last decade, global central banks have joined the gold rush. The amount of gold bought by national banks around the world in 2018 reached the second-highest record on an annual basis, according to the World Gold Council (WGC).

The industrial research company points out that banks bought 651.5 metric tons of precious metal in 2018, increasing 74 percent compared to 2017.

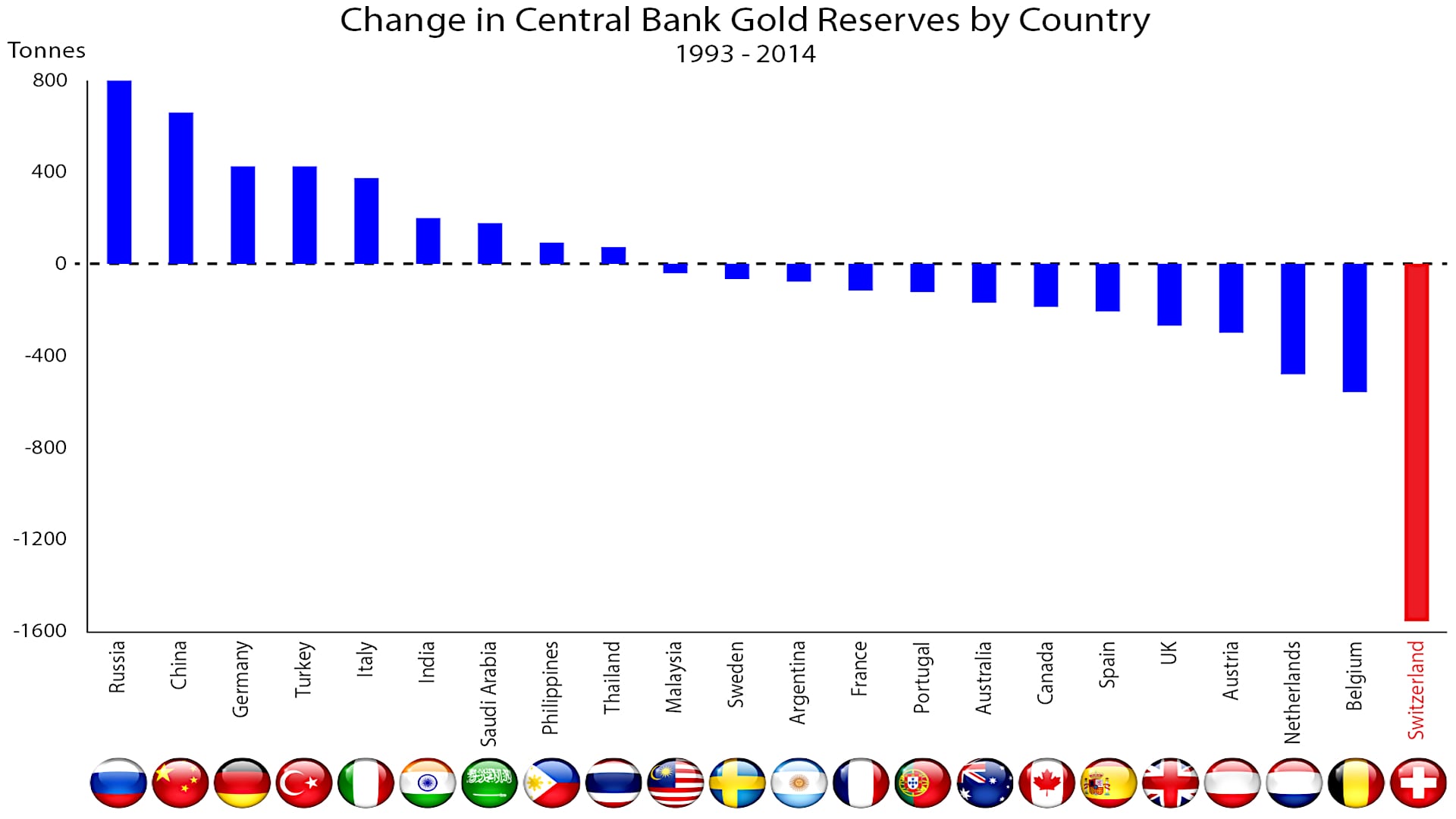

Some countries have increased their gold reserves over the last 20 years. Here is a graph showing top 22 countries with biggest changes in reserves in this period.

Countries on the list of the world’s five largest gold owners:

Table of Contents

5. Russia

Over the past six years, the Russian central bank has built a very positive attitude towards buying gold. In 2017, this country removed China from the list of the five largest gold owners.

Last year, Russia became the world’s leading buyer of gold with a net purchase of 651.5 metric tons.

Russia’s central bank increased foreign exchange reserves by 31.1 tons of gold in February, raising precious metal funds to 2,149 tons.

Ejecting U.S. treasuries at the expense of buying gold is part of a government-approved policy aimed at pushing dollars out of the Russian economy.

4. France

Paris reportedly has 2,518 tons of precious metal, which makes up about 60 percent of France’s total foreign exchange reserves.

Marine Le Pen, president of the National Front, has repeatedly called for a freeze on the sale of national gold, as well as for the repatriation of all French levers held by foreign countries.

3. Italy

With 2,534 tons of gold in its coffers, Italy is in third place. This amount makes up almost 70 percent of the country’s foreign exchange reserves.

According to the policy adopted by the Bank of Italy, gold is the safest investment in times of economic turmoil, but also protection against the instability of the US dollar.

2. Germany

The Bundesbank currently owns 3,483 tons of gold, which makes up more than 70 percent of Germany’s foreign exchange reserves. The German National Bank is trying to repatriate about 674 tons of gold held by the French Bank and the US Federal Reserve (FED).

The repatriation of the national gold is expected to be completed by 2020.

1. USA

Washington reportedly holds the world’s largest gold reserves worth 8,407 tons, which makes up more than 75 percent of national foreign exchange reserves.

The US Federal Reserve (FED) has not been overly active in buying gold, as has been the case with other countries that have done so in order to prevent the devaluation of the dollar.

Our citizens can also protect their capital by buying gold. VAT is not paid on monetary gold bought by governments and on investment gold bought by citizens. It’s about the same gold. Monetary gold is produced in the form of gold bars of 12.5 kg and more, and investment gold from 1g to 1 kg.

The repatriation of the national gold is expected to be completed by 2020.